Understanding Federal Income Tax Brackets

March brings about many different changes – a change in seasons, spring break, the end of the first quarter, and questions on brackets. Not the basketball kind, but the tax kind.

As the tax deadline looms near and dates for payments are quickly approaching, we are frequently asked by clients which income tax bracket they’re in. While knowing the federal income tax bracket you fall into is the knowledge you want to have, in order to make better financial decisions we advise that clients know what their effective tax rate is, too. This turns an elusive concept into one that can be easily applied to day-to-day decision-making, as well as one that factors into cash flow and cash value.

Insights Into the American Tax System

Before jumping into the differences, some insight into the tax system is helpful. The United States uses a progressive tax rate, which takes a larger percentage of income from high-income groups than from lower-income groups. The concept behind this is based on a person’s ability to pay – the less money you make, the lower your tax rate is. While the US income tax system is focused on this, there are also regressive taxes that occur in our economy. A regressive tax is one that creates a harsher burden on lower-income households, as they pay the same tax rate as higher-income households do for goods and services. An example of a regressive tax is sales taxes that are imposed by states and local counties. Proportional or flat taxes are the same as regressive taxes, except they’re for income and not goods and services.

What’s the Difference Between a Tax Bracket and Tax Rate?

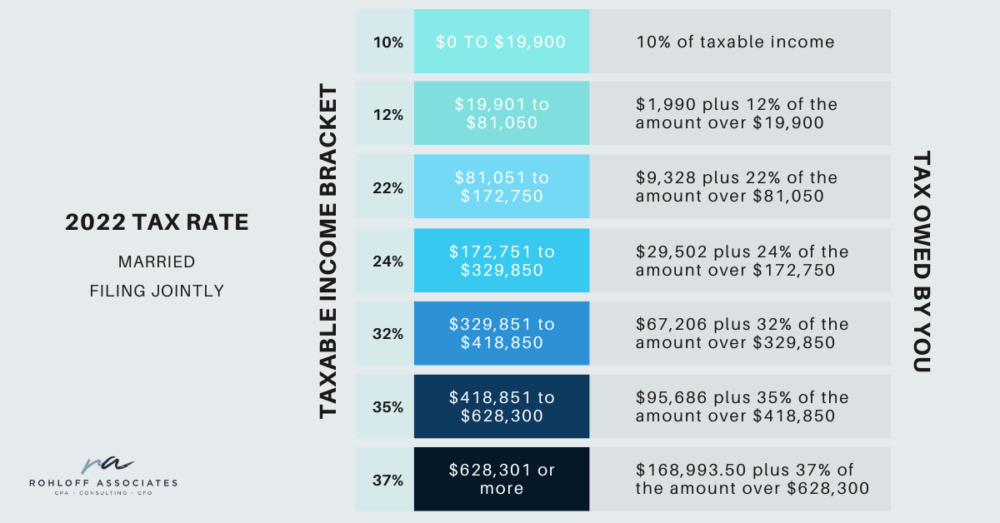

A tax bracket is a range of taxable income that’s assigned a specific tax rate in a progressive tax system. For example, if your annual income is $75,000 then you’re in the $19,901 to $81,050 tax bracket. In this case, you’d pay a tax rate of 12% this year.

Differences in tax rates between brackets only apply to progressive tax systems because only in progressive tax systems can the tax rate change. In a proportional or flat tax system, there are no tax brackets because there is only one tax rate for everybody. Since the United States uses a progressive system, we are focusing on progressive taxes for income tax purposes and decision-making.

How Progressive Tax Systems Work

Now we will lay out how the progressive part of the tax system works, and what it means to be in an income tax bracket:

- Being “in” a tax bracket doesn’t mean you pay that specific tax rate on all forms of income – As a progressive tax, income up to $19,900 is taxed at 10%, then moves to the next tax rate for the next dollar amount. If income continues to grow, the higher tax rates will start coming into play, resulting in higher income tax rates

- Taxable income is broken into chunks – aka tax brackets. Each incremental dollar that is “pushed” into the next bracket becomes important, but overall only that next dollar is taxed at the new rate.

- This only affects the federal income tax – this does not factor in any state taxes – which may have different tax brackets, a flat income tax rate, or no tax at all

Every year the IRS releases the updated tax brackets that vary based upon the filing status of the taxpayer – single, married, widowed, head of household. See below for the 2021 brackets for married filing joint, which we will be comparing against the effective tax rate. With the foundation laid out above on tax brackets, you can see why we are not fans of using brackets as a way to make a business decision:

- Most people don’t know what their TAXABLE income is, which is different than the income in their bank accounts.

- It doesn’t take into account what people owe in state taxes.

- If you ballpark it, you’re making a decision that’s based on a guess and isn’t based on facts.

Use Your Effective Tax Rate to Make Informed Decisions

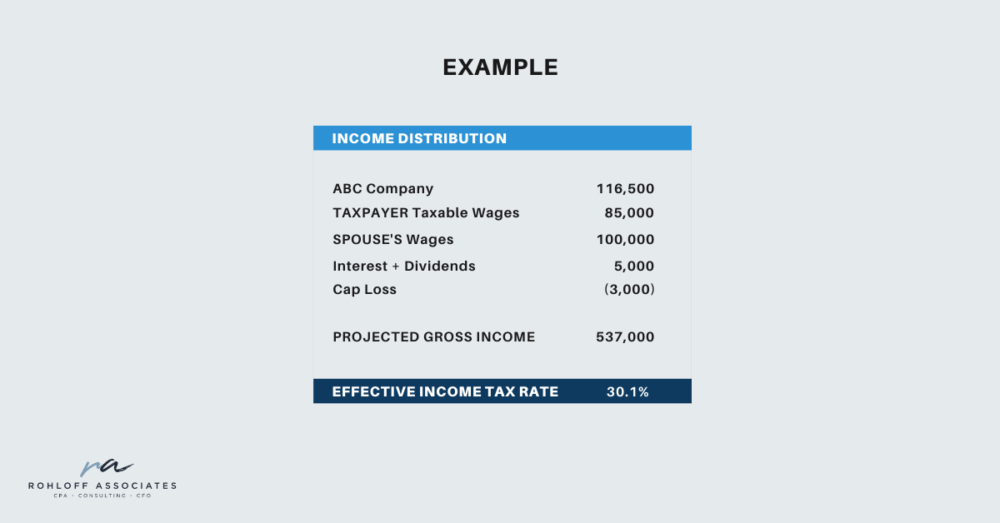

So, how can you make a more informed and accurate decision while also using your tax rate to help? This is where the effective tax rate comes into play. You can calculate your effective tax rate by taking your income and dividing it by the amount of taxes paid. Simple, right?

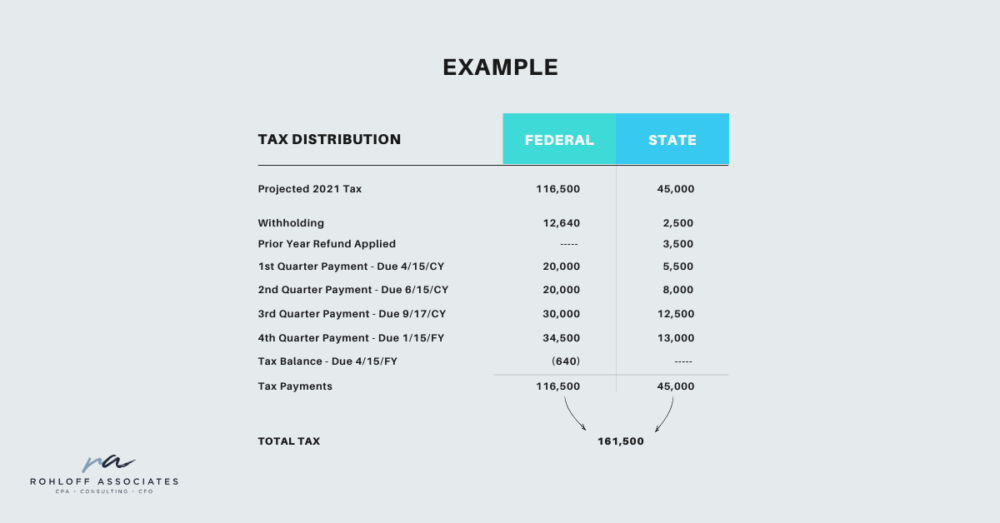

Here is an example of how it lays out:

Using accurate numbers will make decisions much easier to make. Now, we can start giving very focused advice and tax strategies in terms of cash flow and cash value. One of the easiest things to look at is retirement contributions. Rather than saying, “you should contribute to a retirement plan because it’s a good thing to do” we can start talking specifically about you and your business.

Effective Tax Rate Example 1:

If we contribute $10,000 to a retirement plan, you will save $3,010 in taxes. Some follow-up questions we can now ask:

- What plans do you have this year for your business?

- Is there a large capital expenditure coming up? Should we save the money for that instead due to future cash flows?

- How far are you from retiring and what is your exit plan? If your goal is to pass it down to the kids as cost-efficiently as possible, then let’s definitely put the money away.

- Do we need to extend your tax return to pay the retirement during summer because Q1 is lower cash flow?

Effective Tax Rate Example 2:

In order to grow your business, you need to hire an executive-level person. Between salary and benefits, you are looking at an investment of $150,000 and you are waffling:

- With the tax rate, you are offsetting $45,150 in taxes.

- How much will you take off your plate to do more of _?

- What is that worth to you?

Bad Data Leads to Poor Decisions and Bad Outcomes

These are just the easy things to pick out as reasons not to rely only on the tax bracket. Using the actual tax owed will factor in other tax savings that the tax bracket does not as it is only focused on taxable income. One of the biggest deductions that it omits is the Qualified Business Deduction that takes 20% off of business income AFTER taxable income is determined.

Knowing your effective tax rate is essential as a business owner. If I took the same income amounts used in the effective tax rate example and applied it to the tax bracket, this person would fall into the 35% tax bracket. Which, when we factor in the state of MN rates with an effective tax rate, is 5% off. Not a huge difference, but that can cause a big swing.

What if the above person lived in Florida, which is a state with no income taxes? Their effective rate would actually be 21.7%. Now we have a swing of 13.3%. Would that have changed your thoughts on contributing $10,000 to retirement to save $2,170 in tax? Or what about that person we just thought of hiring in Example 2 who is now costing $12,600 more than we thought?

We Make Decisions Based on Your Specific Tax Strategy

Everyone is getting ready to file their 2021 taxes at the exact same time they are trying to look ahead to map a 2022 financial strategy. In both cases, it’s a good idea to understand what tax brackets and rates exist, as well as how to use all tools at your disposal to make informed tax decisions and business decisions for 2022.

Overall, at RA we are committed to providing accurate data to make the most informed decisions possible. Our goal is to make REAL decisions based on REAL financials. This is why we take the extra time and extra steps to go beyond what is expected or talked about and dive into your specific tax strategy. If you’re interested in continuing the conversation, don’t hesitate to contact our team. Whether you have a tax question or want an expert by your side this tax season, we’re here to help!